GRC 1.0 Is Dead — And It’s Long Overdue

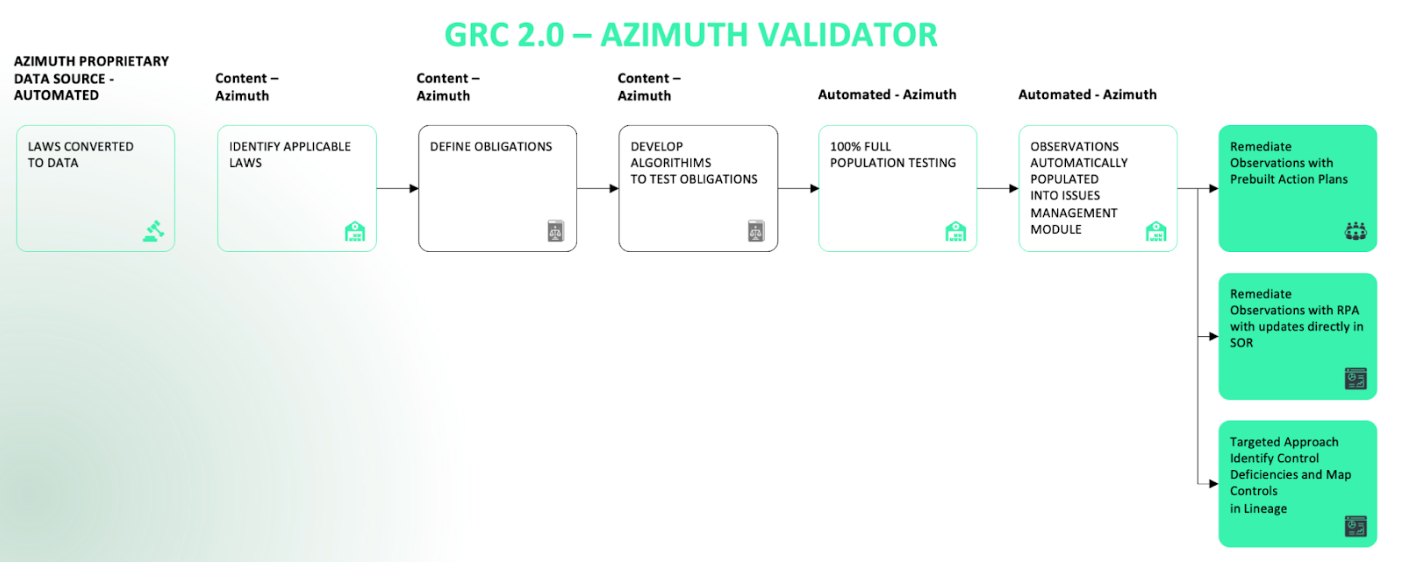

For over two decades, organizations have relied on a Governance, Risk, and Compliance (GRC) model that is fundamentally broken. GRC 1.0 — along with its more recent rebrand as Integrated Risk Management (IRM) — promised operational alignment, proactive compliance, and streamlined oversight. In practice, however, it delivered little more than fragmented systems, spreadsheet sprawl, and manual processes masked by marketing jargon.

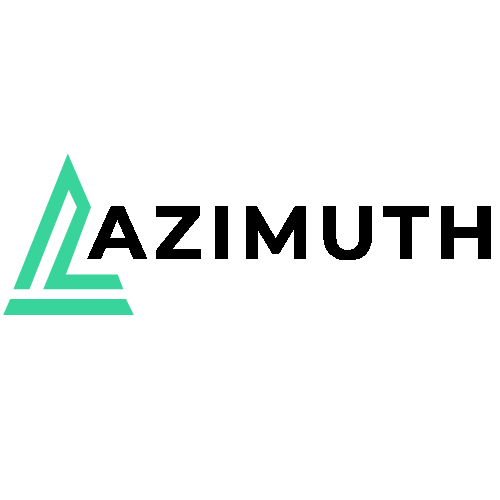

The traditional approach centers on mapping controls to regulatory requirements. On paper, this seems rational. In reality, it means that companies are asked to translate legal frameworks into internal checklists, build and maintain custom workflows, and rely on periodic sampling — all while assuming that sampled controls reflect systemic compliance. They don’t.

The traditional model leaves organizations exposed in ways that are hard to justify today. It fails to identify areas where controls are missing altogether, allows existing controls to shift without notice, and gives leaders the illusion that everything is under control when it isn’t. Instead of offering clarity, compliance turns into an exercise in educated guessing. Companies are left to manage the heavy lifting — building systems, interpreting regulations, and enforcing policies — all while struggling to see whether their efforts are actually working or paying off.

And despite heavy investment, organizations cannot answer three foundational questions with confidence:

- Are we actually compliant?

- Where are we exposed?

- What is the return on this compliance effort?

The answer, too often, is silence.

GRC 2.0: A New Model for a New Era

No Guesswork. 100% Compliance. The Unachievable Made Achievable.

Azimuth didn’t set out to improve GRC 1.0. We replaced it.

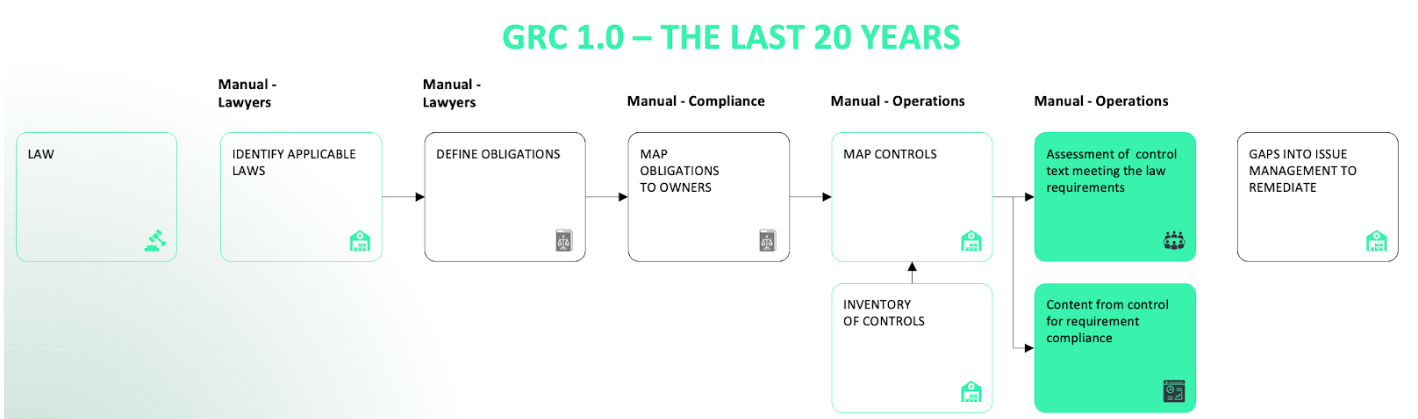

GRC 2.0 represents a complete shift in methodology. Rather than simply mapping controls to obligations, GRC 2.0 operationalizes compliance by connecting laws, tasks, transactions, workflows, and owners into a fully integrated, automated system.

With Azimuth’s VALIDATOR, compliance testing moves from periodic sampling to full-population, real-time coverage. Every transaction is automatically tested — closing gaps, exposing risk immediately, and eliminating the need to hope that a sample is representative of the whole. There’s no guesswork, no patchwork, and no lag between change and response.

The results speak for themselves: one client reported a 680,000% increase in testing efficiency. This is not hyperbole — it reflects the leap from manual, sample-based validation to continuous, automated, full-scale testing. The cost, accuracy, and speed gains are not incremental. They’re transformative.

GRC That Performs at Scale

What GRC 2.0 Delivers That Older Systems Never Could

- It costs less — plain and simple.

When you’re no longer buried in spreadsheets, manual checks, and consulting fees, the savings start to add up fast. There’s no need to patch together old systems or reinvent the wheel every quarter. - You actually see what’s going on.

It’s not about dashboards that look good — it’s about knowing where the real problems are and being able to fix them before they grow. The clarity is immediate and practical. - People are accountable, and it’s obvious who owns what.

No more chasing down emails or trying to remember who was in charge of a task. Every obligation is connected to a name, which means nothing gets lost in the shuffle. - Change doesn’t throw everything into chaos.

Regulations shift — they always do. But instead of scrambling to catch up, the system adjusts. It’s flexible in a way legacy platforms just aren’t. - You can finally prove that it’s working.

This isn’t just about staying out of trouble. With VALIDATOR, you can show what’s working, what’s not, and how your efforts are delivering real results — with numbers to back it up.

This is the system compliance professionals have long imagined but never believed possible. GRC 1.0 — and its rebranded cousin, IRM — simply cannot keep up with the speed and complexity of today’s regulatory landscape. They never could.

The Future of Compliance Is Here

For too long, we have tolerated tools that fall short — systems that demand excessive effort while delivering minimal clarity. Azimuth was built to meet the current moment, enabling a shift from reactive maintenance to proactive performance.

GRC 1.0 is over.

Azimuth is GRC 2.0.