THE FUTURE OF REGULATORY INTELLEGENCE HAS A NAME:

VAL

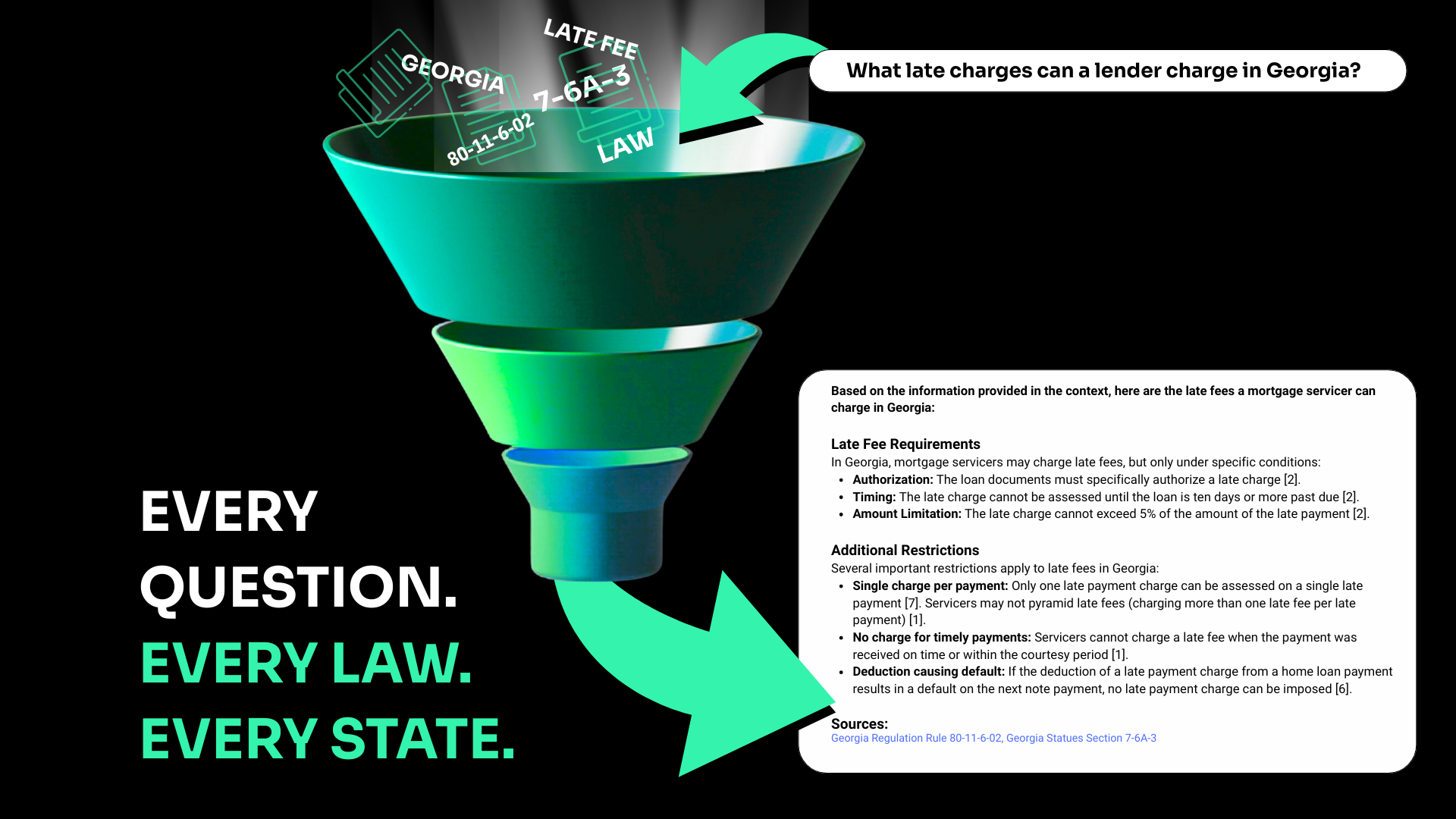

Get lawyer-written answers you can defend — in seconds.

Answers You Can Defend.

Compliance questions don’t need more noise—just answers you can defend.

VAL is Azimuth’s compliance intelligence assistant for servicers and banking compliance teams, delivering source-backed answers in seconds.

Curated content. Not crawled. Lawyer-written requirements. Hallucination resistant.

Regulatory Intelligence. Structured for Precision.

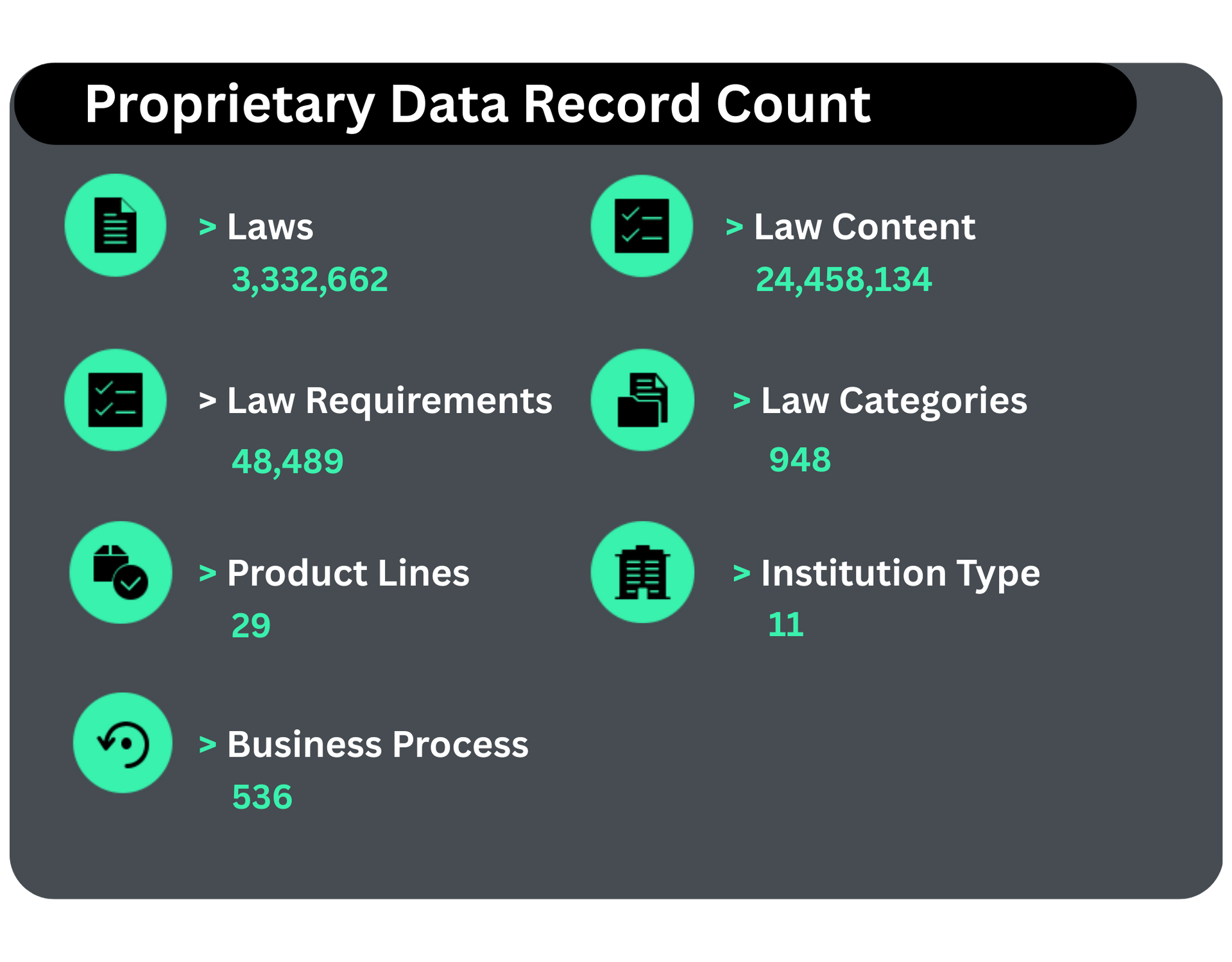

The depth shown here isn’t volume for marketing — it’s architecture.

Millions of regulatory records, categorized across products, institutions, and operational processes, form the foundation of VAL. That structure is what allows VAL to deliver cited, defensible answers instead of blended summaries.

This is infrastructure — not a chatbot.

Ready to transform compliance?

Discover how VAL delivers source-backed answers in seconds—with curated content, lawyer-written requirements, and hallucination-resistant regulatory intelligence built for servicers and banking compliance teams.

Frequently Asked Questions

Ready to transform compliance?

Discover how VAL delivers source-backed answers in seconds—with curated content, lawyer-written requirements, and hallucination-resistant regulatory intelligence built for servicers and banking compliance teams.