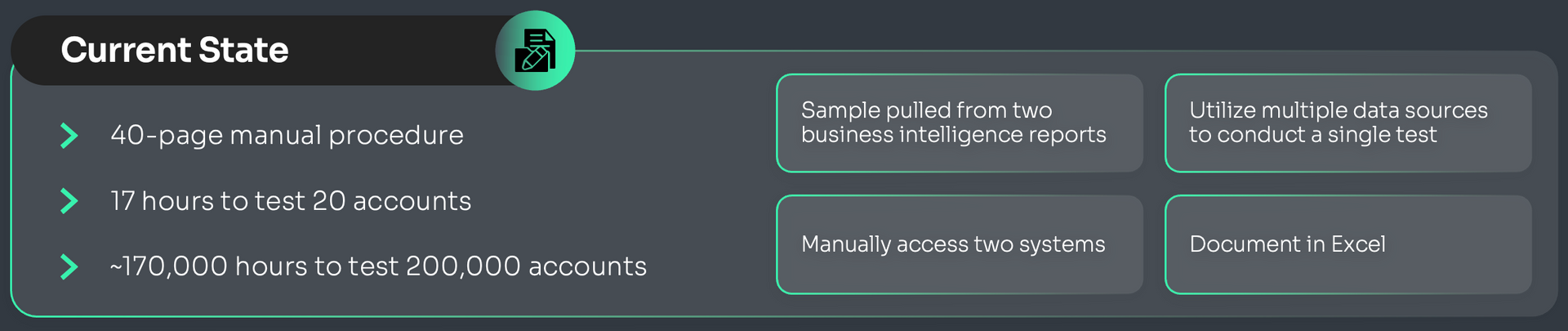

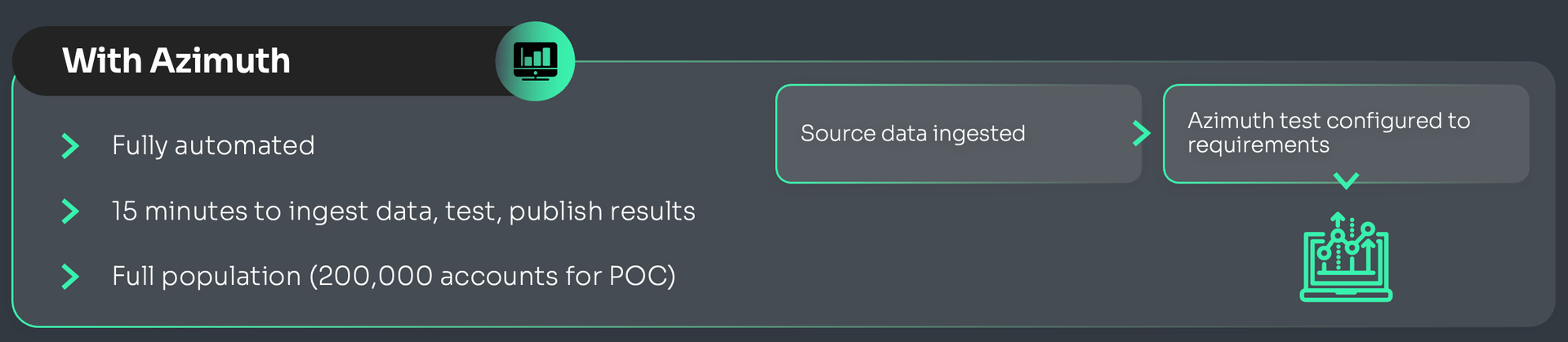

BOOST EFFICIENCY BY 680,000%*

WITH Azimuth VALIDATOR

VALIDATOR automates full-population testing of regulatory requirements and offers advanced analytics to monitor your organization’s compliance.

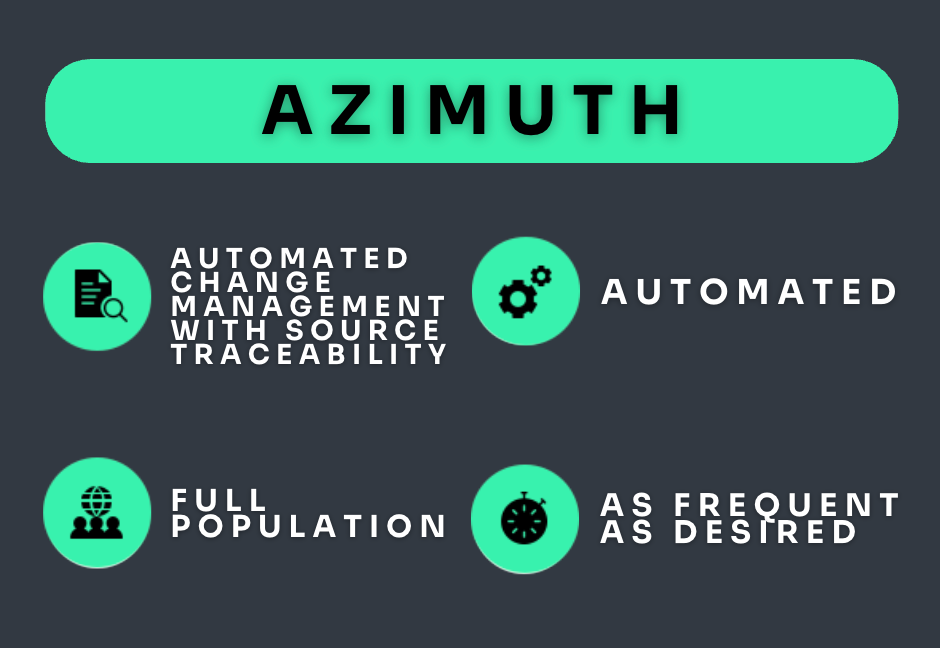

DRIVE EFFICIENCY THROUGH AUTOMATION

TAKE A DEEPER DIVE

Ready to transform compliance? Discover how VALIDATOR simplifies processes, cuts costs, and eliminates risk with automated full-population testing.

Ensure Full Compliance: Eliminate risks by automating full-population testing and covering every aspect of your portfolio.

Frequently Asked Questions

Have a question? We’re here to help.