Eliminate Blind Spots with

Automated QC

VALIDATOR automates compliance and shifts audits to daily monitoring,

boosting efficiency by 680,000%.

Improved Efficiency

- Eliminates manual sampling with automation

- Replaces Excel and SharePoint systems

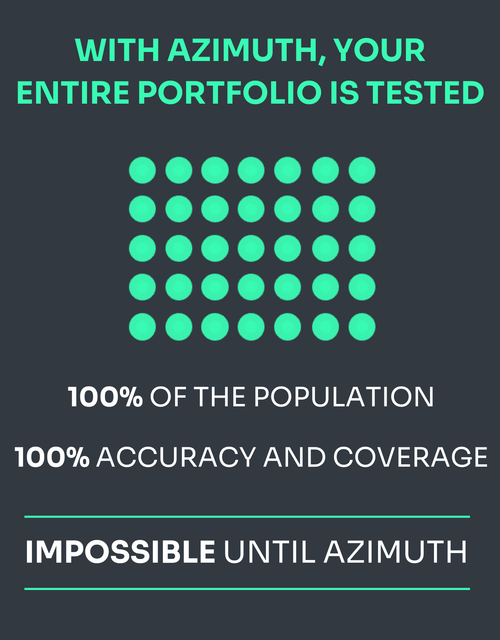

Increased Coverage

- Expand from sample testing to full analysis

- Cut compliance costs with automation

- Spot more issues, sooner, everywhere

More Frequent

- Replace annual audits with daily testing

- Eliminate manual, limited-scope processes

- Early resolution ensures customer fairness

FEATURED PRESS RELEASE

Azimuth extends relationship with Truist to enhance its automation capabilities

Azimuth, a pioneer in compliance automation, announced today that it is growing its strategic partnership with Truist Financial Corp (NYSE: TFC). With this multi-year expansion of their current partnership, Truist will implement Azimuth’s VALIDATOR software, enabling the bank to deploy automated, full-population compliance monitoring across multiple consumer businesses.

Insights FrOM AZIMUTH

For over two decades, organizations have relied on a Governance, Risk, and Compliance (GRC) model that is fundamentally broken. GRC 1.0 — along with its more recent rebrand as Integrated Risk Management (IRM) — promised operational alignment, proactive compliance, and streamlined oversight. In practice, however, it delivered little more than fragmented systems, spreadsheet sprawl, and manual processes masked by marketing jargon. The traditional approach centers on mapping controls to regulatory requirements. On paper, this seems rational. In reality, it means that companies are asked to translate legal frameworks into internal checklists, build and maintain custom workflows, and rely on periodic sampling — all while assuming that sampled controls reflect systemic compliance. They don’t. The traditional model leaves organizations exposed in ways that are hard to justify today. It fails to identify areas where controls are missing altogether, allows existing controls to shift without notice, and gives leaders the illusion that everything is under control when it isn’t. Instead of offering clarity, compliance turns into an exercise in educated guessing. Companies are left to manage the heavy lifting — building systems, interpreting regulations, and enforcing policies — all while struggling to see whether their efforts are actually working or paying off.

Azimuth, a pioneer in compliance automation, announced today that it is growing its strategic partnership with Truist Financial Corp (NYSE: TFC). With this multi-year expansion of their current partnership, Truist will implement Azimuth’s VALIDATOR software, enabling the bank to deploy automated, full-population compliance monitoring across multiple consumer businesses.

Change is happening overnight at the Consumer Financial Protection Bureau (CFPB) As we await the Senate confirmation of Rohit Chopra to lead the Consumer Financial Protection Bureau, there are things you can do to prepare for what’s to come. We know from Chopra’s background and experience, more intense scrutiny is on the horizon to protect consumers. That means companies and organizations need to step up compliance operations.